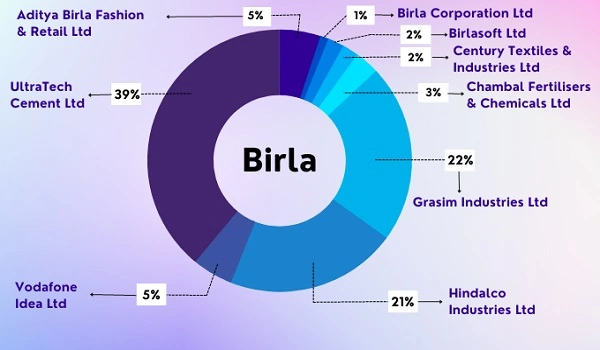

How to Save Taxes When Buying Birla Evara on Sarjapur Road

Buying a home at Birla Evara on Sarjapur Road, Bangalore, is more than just owning a beautiful house. It’s also about using tax rules to keep more money in your pocket. Here’s a simple guide to the main home loan tax benefits you can claim.

- What it is: The extra money you pay on your loan (interest) can lower your taxable income.

- Self-occupied home: You can claim up to ₹2 lakh per year.

- If you rent out: There’s no upper limit, so all your interest payments reduce your tax.

Tip: Track each year’s interest certificate from your bank. You’ll need this when filing your return.

- What it is: Part of your EMI goes toward paying back the original loan amount (principal).

- How much: You can deduct up to ₹1.5 lakh a year under Section 80C.

- When: Only after the builder hands over your apartment (possession).

If this is your first home:

- Section 80EE: You may claim extra interest deduction (up to ₹50,000), if your loan and property values meet limits set by the Income Tax Act.

- Section 80EEA: On affordable homes, you could get up to ₹1.5 lakh more, if your stamp duty value is below ₹45 lakh and loan under ₹35 lakh.

Make sure you check the exact conditions and file these claims in the right financial year.

When you buy an under-construction flat:

- You pay interest before possession.

- After you move in, you can spread that pre-construction interest over five years, claiming one-fifth each year.

This tip helps you plan your tax savings over several years instead of just one.

- Start Early: Note down loan dates and interest certificates as soon as you get them.

- Combine Deductions: Use Section 80D (health insurance) or Section 80TTA (savings account interest) alongside home loan benefits.

- Check Your Forms: Keep Form 16, Form 26AS, and your bank statements ready when filing.

- Consult an Expert: A tax advisor can spot extra savings you might miss.

Birla Evara on Sarjapur Road isn’t just a luxury address—it’s a way to build wealth while enjoying big tax breaks. By understanding Sections 24(b), 80C, 80EE/80EEA, and pre-construction interest rules, you can plan your taxes like a pro. Talk to your bank and a tax advisor early to make every rupee count.