Apartment Cost Trends Today What You Need To Know

Understanding how prices are moving can help you pick the right area and budget. From tech hubs to quiet outskirts, the city’s real estate market is changing fast. In this guide, you’ll learn the latest trends in apartment costs—and how they tie into the Bangalore real estate market forecast 2025.

Price Growth in Prime NeighborhoodsOver the past few years, well-known areas have seen steady gains:

- Whitefield, HSR Layout & Sarjapur Road are closest to IT parks, top schools, hospitals, and malls.

- Sarjapur Road averaged around ₹5,000 per sq ft in 2020. By 2024, it climbed to about ₹9,300, and experts predict nearly ₹12,000 per sq ft in 2025.

Demand in these localities remains strong. That steady buying interest is what drives the projected 5–10% annual rise across key corridors.

Affordable Options on the OutskirtsAs central zones get pricier, many buyers look to suburbs:

- Chandapura starts at just ₹5,000 per sq ft.

- North Bangalore localities like Yelahanka hover around ₹6,000 per sq ft.

- Kodathi Village off Sarjapur Road offers lower entry prices with growing infrastructure.

That shift means some pockets—even near Sarjapur—have seen Bangalore. property prices falling by up to 15–20% in the last year. These dips can be chances to buy at a discount.

Luxury Segment & Highest Square-Foot Rates in BangaloreFor buyers seeking top-end living, premium enclaves command the highest rates in town. Here are a few standout figures:

- Richmond Road: ₹24,300 per sq ft

- Rajajinagar: ₹22,050 per sq ft

- Iblur Village: ₹19,350 per sq ft

High-income professionals and NRIs still favor these addresses for quality build, central location, and strong rental yields.

Rising Construction Costs & Buyer PerksMaterial prices—steel, cement, wood—have ticked up nationally. Developers are passing some costs on, but many also offer:

- Flexible payment plans (zero-interest instalments)

- Early-bird discounts on launch-phase units

If you plan early, you can lock in lower prices before full escalation takes effect.

Infrastructure Growth Is Driving ValueLarge projects are reshaping Bangalore’s edges:

- Metro expansions toward Whitefield and KR Puram

- The Peripheral Ring Road (PRR) linking North and South Bangalore

- New tech parks across East Bangalore

These moves are part of the wider Bangalore real estate market forecast 2025, which predicts 5–7% annual appreciation on average. Areas near upcoming metro stations often outperform the rest.

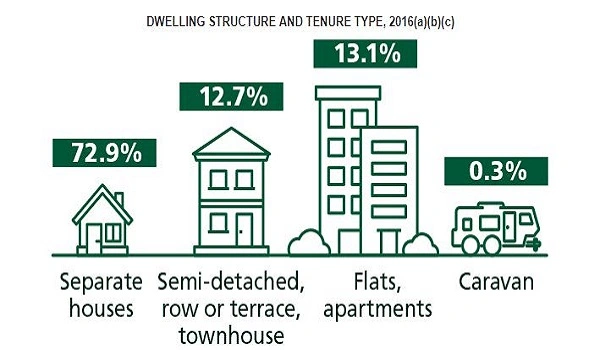

What Buyers Want NowModern home seekers look for:

- Plenty of natural light and open layouts for work-from-home setups

- Energy-efficient fittings to cut bills

- Green spaces or on-site gardens for healthier living

Projects like Birla Evara combine these features. They tend to sell faster, even at a small premium, because they match today’s lifestyle needs.

Quick Tip for Smart InvestmentFor strong rental returns, aim for gated communities within 1–2 km of future metro stops. You could see yields of 10–20% per year, especially on 2 BHK units renting for ₹35,000–₹40,000 monthly.

Staying on top of these trends—price gains in top sectors, bargains on the outskirts, and the highest square-foot hotspots—will help you make a smart move in Bangalore’s evolving market. Keep this guide handy as you plan your next purchase!